Unlike other real estate investments, hospitality properties are operating businesses that require specialized understanding of both the real estate and operations side of the business. Coldwell Banker Commercial® affiliated hospitality professionals offer experience in hotel operations management, hospitality occupancy and revenue trends, real estate and valuation, and will tailor their services to meet your specific needs.

While there are five primary hospitality revenue sources that may determine a property’s value - travel and tourism, food and beverage, lodging, entertainment and recreation, and meetings and events - and they are each highly interconnected. Often a single commercial property will span multiple sectors, allowing the business to provide a complete and enhanced consumer experience.

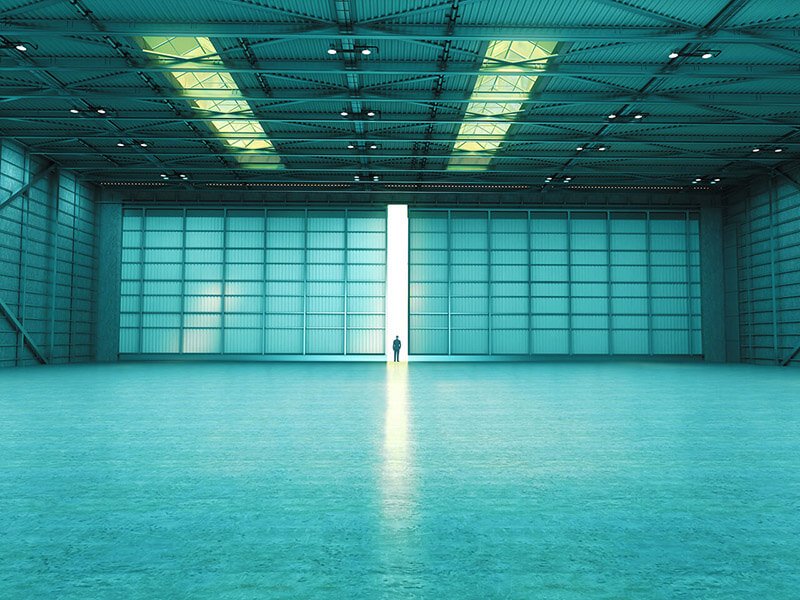

Industrial real estate has played a vital role in the global economy since the Industrial Revolution began in the 1750s. Nearly every item we use today - furniture, appliances, clothing, cleaning supplies, beauty products, even the food we eat - is produced, stored or shipped through an industrial building. The land and buildings where goods are produced, manufactured, assembled, stored and distributed make up the industrial real estate industry.

Several factors are driving the demand for industrial real estate, making it a substantial investment opportunity. The rise of robotics in manufacturing has automated processes and greatly reduced labor costs. The shift toward eCommerce has changed the face of our economy and generated a huge need for warehouse and shipping space.

Because most cities limit the construction and operations of industry to zoned areas to avoid it disrupting residences and communities, understanding local zoning laws is critical for investors. In many cases, the zoning regulations even dictate where specific types of industrial activities can take place. It’s also important to consider what class a building is rated and which is most appropriate for your business needs.

Coldwell Banker Commercial® affiliated professionals offer expertise in all aspects of industrial real estate and can provide comprehensive services to help you meet your business goals.

Land for commercial use can be one of the most lucrative investments – if it’s the right land under the right terms. There are many factors that go into choosing a parcel of land for your real estate project, including size, location, zoning and proximity to transportation.

A successful investment comes with having a thorough understanding of planning, zoning, engineering issues, availability of utilities and mineral and water rights. Coldwell Banker Commercial® affiliated professionals provide the information and services you need to maximize the value of your real estate portfolio and your return on investment.

Multifamily residential properties can be a lucrative investment and provide a stable long-term income opportunity. Properties range from a two-unit duplex to large apartment complexes with elaborate amenities and services. Because renting is an attractive and affordable option for today’s mobile workforce, multifamily properties are experiencing high demand.

Coldwell Banker Commercial® affiliated multifamily professionals are well-versed in the unique trends, opportunities and challenges that shape successful multifamily transactions.

Commercial office space is used by businesses exclusively for administrative and management activities and can range from urban skyscrapers and high-rise properties to smaller buildings grouped in suburban office parks. Office space is often formatted based on the specific needs of a company and includes traditional office, creative office, co-working space, executive suites, and flex space. Properties can be leased by multiple tenants or occupied by one company.

There are three primary classifications of office space, which vary by the property’s age, location, accessibility, quality of infrastructure and amenities. A Coldwell Banker Commercial® affiliated professional can help you understand the pros and cons of each class for your specific business needs.

Retail space is commercial real estate property where goods and services are sold directly to buyers in person, who are purchasing for their own use. These brick-and-mortar storefronts including strip malls, shopping centers, community retail centers, power centers, shopping malls and out parcels. Properties may be operated with a single tenant or multiple tenants who typically lease space from the property’s owner.

Commercial properties are considered distressed primarily when the owner experiences financial trouble and is unable to pay the mortgage or other debts. However, the “distressed” label also applies to properties that have deteriorating conditions either from poor management or environmental causes. As a result, distressed properties often have below-market occupancy rates, high vacancy rates or have become obsolete, either physically or functionally. In such cases, buyers who are willing to undertake rehabilitating or repositioning the property may find a unique investment opportunity.

Commercial agricultural properties are used to generate revenue through the production of crops for human consumption, such as fruits, vegetables and meat, or raising livestock for sale. Agricultural land can include farmland, ranches, orchards, vineyards and other types of agricultural operations. Some agricultural properties may include existing infrastructure like barns, silos, irrigation systems, poultry houses and greenhouses, which can increase the value of a property. As with other types of commercial real estate, a property’s value and potential for revenue are influenced by several factors, including location, accessibility, market demand and the quality and maintenance of infrastructure.

Coldwell Banker Commercial® affiliated professionals with agricultural expertise are well-versed in the unique opportunities and challenges that shape successful agricultural land transactions.